Protect Your Kids

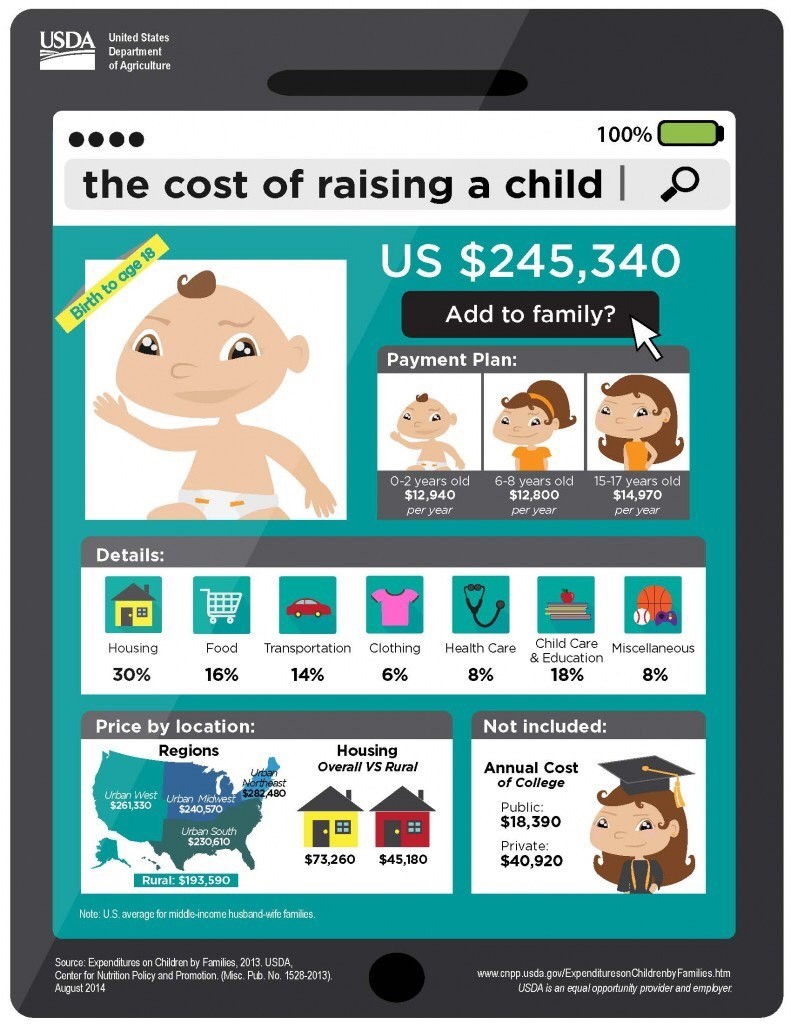

Do you know how much it takes to raise a child these days? Are you sitting down? That would be almost a quarter of a million dollars. It costs $245,000 to raise a child born in 2013 until they hit 18, according to the U.S. Dept. of Agriculture.

This is not about a luxury upbringing. This is no Kardashian-esque baby outfitted in cashmere onesies. This is not about a privileged college education, because these numbers do not include the cost of college. That’s extra. Add on about $18,000 a year for public and $41,000 a year for private college. This number—$245,000—is a place to live, food, clothes, health care … the basics. The average middle-income family is spending around $13,000 a year on their child.

You’re here to take care of these expenses now. But what happens if something were to happen to you? If an average middle-income family is spending around $13,000 a year on their child (see the infographic below) that money would have to come from somewhere.

That’s where life insurance comes in. If you take between 1% and 2% of what you already spend on your child each year—or about $200—it would pay the yearly premium for $250,000 in term life insurance coverage. Something happens to you—your child is OK financially.

But the truth is, setting aside 1%-2% of what you’re already spending on your child is a small price to pay to protect them. No reason to wait. Give us a call or email at Info@TrekInsuranceGroup.com