Metallic Levels for Individuals and Group Health Coverage (less than 50+ employees)

Metallic Levels for Individuals and Group Health Coverage (less than 50+ employees):

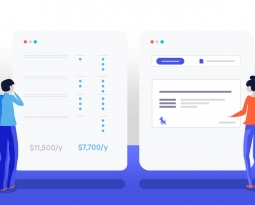

To make health insurance plans easier to compare, Obamacare groups plans into metal tiers named after metals to help you understand how much coverage they offer: Bronze, Silver, Gold, and Platinum. But don’t go reaching for the Platinum Plans first, more isn’t always better…

Each tier is based on its “actuarial value”—a fancy word for the percentage of health care costs your insurance pays on average, over the course of a year. If the actuarial value is 60 percent, you (the consumer) will only pay 40 percent of the total amount of health care (including all premiums, deductibles, coinsurance and copays).

You can use these metal tiers as a starting point to help you narrow down your search. For example, if you’re a healthy individual who rarely gets sick or injured, you might want to focus your search on Bronze plans. Although they pay a smaller percentage of your health expenses, your total expenses might be too low to offset the higher premiums of a Platinum plan.

The four new metal plans are distinguished from one another by their “actuarial value.” Actuarial value refers to the average amount of insurance expenses that would be paid for by the plan. The higher the actuarial value of a plan, the lower the out-of-pocket costs for the plan member. With respect to the plan names, a Platinum Plan covers 90% of covered medical expenses while a Bronze Plan only covers 60%.

Actuarial Value of types of plans (ACA)

Bronze – 60%

Silver – 70%

Gold – 80%

Platinum – 90%

Catastrophic Plans – Variable*

In the marketplace, it is expected that an insurer will charge progressively higher premiums among the plans with Bronze Plans having the lowest premiums and Platinum having the highest premiums. However, this considers metal plans offered by a single insurance company. It is possible that one company’s Silver Plan could be cheaper than another company’s Bronze Plan. All plans, whether Bronze, Silver, Gold or Platinum, will have a maximum out-of-pocket amount that an enrolled individual can pay in a calendar year before their plan covers the rest of their out-of-pocket expenses. In 2016 the maximum out-of-pocket limit for Obamacare plans is $6,850 for an individual, or $13,700 for a family.

All metal plans must offer essential health coverage These are the basic insurance benefit requirements the Affordable Care Act stipulates all qualified health plans must provide to enrollees. States have the discretion to require additional benefits beyond the Essential Health Benefits. However, these are minimum benefits and plans can choose to offer additional benefits so long as the essential benefits are properly covered. It is also important to note that since plans differ by the amount of costs they cover; the aforementioned plans may all cover the essential health benefits but they can cost the member different amounts due to the differences in insurance expenses paid for by the plans. Below is a brief summary of the 10 Essential Health Benefits that all metal plans must offer:

- Ambulatory patient services (such as doctor visits and other care you receive as a “walk-in” as opposed to services a person receives as an “inpatient” at a hospital or other care facility)

- Emergency services – These include care received in an Emergency Room

- Hospitalization – These include medically-necessary surgeries and other inpatient procedures

- Maternity Care and newborn care

- Mental health services & substance use disorder services – These services include counseling as well as behavioral health treatment for alcohol abuse and drug abuse

- Drug coverage – This applies to prescription medication and not over-the-counter drugs

- Rehabilitative and habilitative services and devices – Rehabilitation covers services such as relearning to speak after an aneurysm while habilitative services involve learning a new skill such as managing diabetes through various behaviors

- Laboratory tests and services (for example, X-Rays)

- Preventive and wellness services as well as the management of chronic diseases

- Pediatric medical services (including both oral care and vision care)

Individual insurance companies are not required to offer plans from all four metal tiers. If the insurer chooses to participate in the Federally-facilitated marketplace (FFM) or one or more state marketplaces, they must offer at least one Silver plan and at least one Gold plan. There is also a catastrophic plan for individuals who can demonstrate problems affording a Bronze Plan. Tax subsidies cannot be used to reduce premiums for catastrophic plans. *Catastrophic plans are also generally only available to individuals under the age of 30.